|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

New FHA Refinance Program: An Introduction and BackgroundUnderstanding the FHA Refinance ProgramThe Federal Housing Administration (FHA) has introduced a new refinance program aimed at assisting homeowners in optimizing their mortgage terms. This initiative focuses on providing more accessible refinancing options to those who might not qualify under conventional refinancing criteria. Let's delve into the details of this program. Key Features of the Program

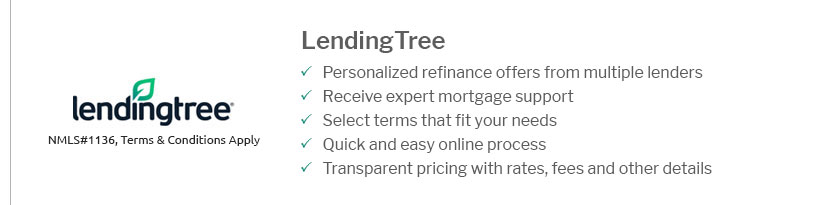

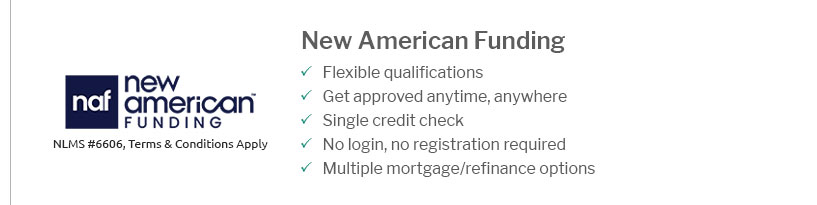

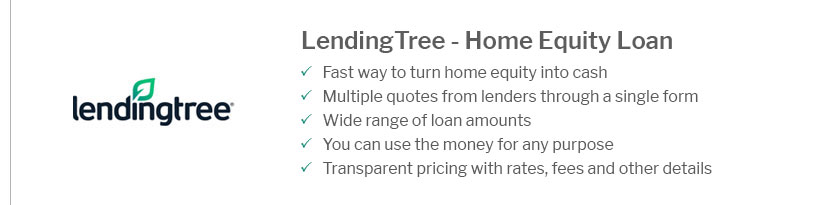

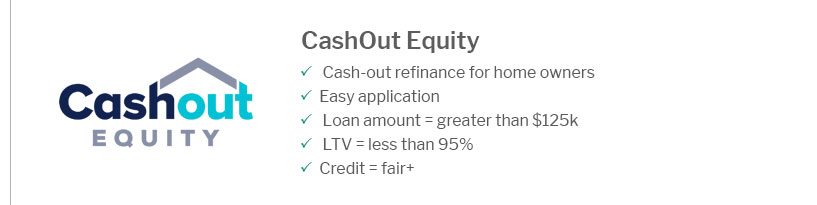

Benefits of the FHA Refinance ProgramBy leveraging the new FHA refinance program, homeowners can enjoy several benefits. These include lower interest rates, which lead to reduced monthly payments and long-term savings. The program also offers the opportunity to switch from an adjustable-rate mortgage to a fixed-rate mortgage, providing stability against market fluctuations. Eligibility CriteriaTo qualify for the new FHA refinance program, applicants must meet specific criteria. These include having a verifiable income, maintaining the home as a primary residence, and being current on mortgage payments. Additionally, there must be a tangible net benefit to the borrower, ensuring the refinancing leads to improved financial conditions. How to Apply for the FHA Refinance ProgramThe application process for the FHA refinance program is straightforward. Homeowners interested in applying should gather necessary documents such as income statements, existing loan information, and property details. It's advisable to consult with an FHA-approved lender to explore all options and find the best terms. For those also interested in VA loan options, exploring refi va loan rates can provide additional insight into refinancing opportunities. Common Pitfalls to Avoid

FAQs About the New FHA Refinance ProgramWhat is the primary goal of the new FHA refinance program?The main goal of the new FHA refinance program is to offer more accessible refinancing options for homeowners, particularly those who may not qualify for traditional refinancing due to credit score limitations or other factors. How does the FHA refinance program affect monthly mortgage payments?By refinancing through the FHA program, homeowners can secure lower interest rates, which typically results in reduced monthly mortgage payments, thus enhancing affordability and financial management. Can this program help if I have an adjustable-rate mortgage?Yes, the FHA refinance program allows homeowners to switch from an adjustable-rate mortgage to a fixed-rate mortgage, providing more stability and predictability in payments. https://www.pennymac.com/refinancing-products/fha-streamline-refinance

This program is streamlined because it doesn't have many of the income and appraisal requirements that are included with standard refinance programs. As a ... https://themortgagereports.com/27259/fha-cash-out-refinance-guidelines-mortgage-rates

Learn how the FHA cash-out program works, including FHA cash-out refinance guidelines, loan limits, and interest rates. https://www.youtube.com/watch?v=Ew1CdAdGTbE

, we dive deep into the benefits of the FHA Streamline Refinance program. Whether you're a current FHA loan holder or just curious about the ...

|

|---|